Disciplined Capital in an Uncertain Cycle - LP Survey 2025

Europe’s LPs reset for a disciplined 2025

Summary:

European institutional investors entered 2025 with measured conviction. Balentic’s latest LP Survey captures how capital is being redeployed across private markets, from infrastructure and private credit to secondaries and the energy transition, as allocators balance long-term opportunity with short-term liquidity pressure.

A year defined by recalibration

Europe’s limited partners are stepping into 2025 with a mix of restraint and resolve. Balentic’s 2025 LP Survey, capturing responses from a diverse group of European institutional investors, offers a snapshot of how capital is flowing into private markets amid inflation pressures, high rates, and a slow-burning valuation reset.

While uncertainty continues to define the macro backdrop, the data points to something subtler than risk aversion: a disciplined recalibration of capital, strategy, and conviction.

Who’s investing and how they’re positioned

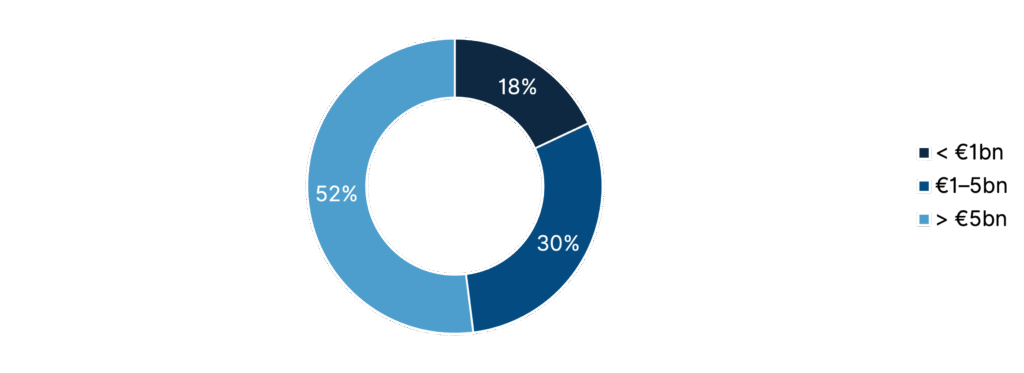

The survey drew responses from a cross-section of European institutions, from public pensions and sovereign wealth funds to endowments and family offices, together representing over €350 billion in private markets AUM. More than half of respondents (52%) manage over €5 billion, and nearly a third have been investing in alternatives for more than a decade. This depth of experience shapes a sentiment that is neither euphoric nor defensive, but measured.

Figure 1: Survey Captures Over €350bn in Institutional Capital

Source: Balentic Investor Survey 2025

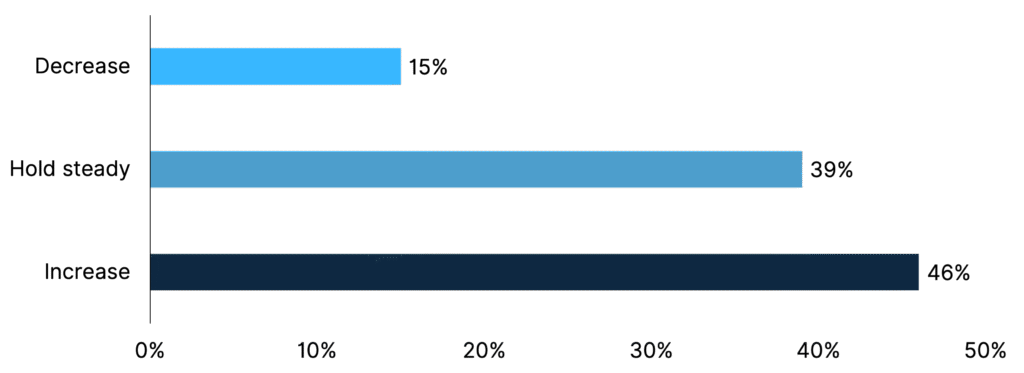

That measured tone comes through clearly in allocation plans. Forty-six percent of LPs expect to increase their private markets allocations in 2025, while 39% plan to hold steady and just 15% anticipate reductions. Yet within that headline optimism lies caution.

Figure 2: LPs Stay the Course — With Nearly Half Raising Allocations

Source: Balentic Investor Survey 2025

Many respondents flagged portfolio liquidity constraints, the denominator effect, and extended holding periods as limiting near-term flexibility. Several also cited a “lagged reset” between public and private valuations – a reminder that while pricing discipline has improved, exits remain subdued.

Capital is moving, but carefully

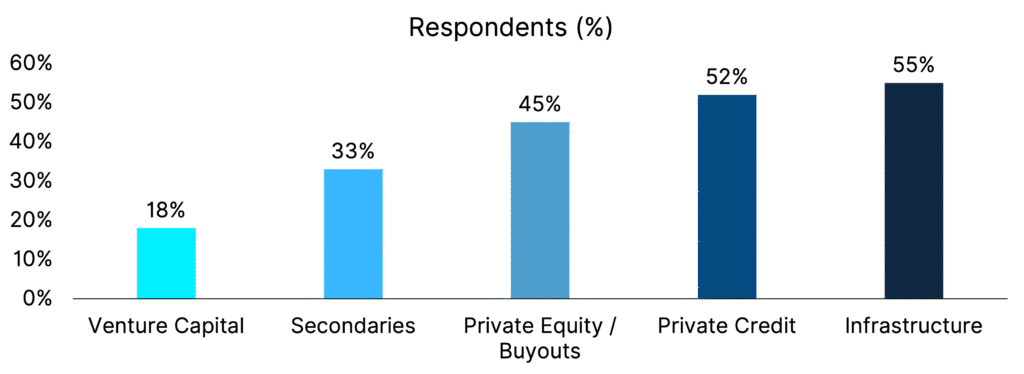

When asked where incremental capital will flow, LPs pointed first to infrastructure and private credit, both cited by over half of respondents as preferred destinations for 2025 deployment. Private equity buyouts follow closely, buoyed by improving entry valuations, though sentiment towards venture capital remains muted – with just 18% planning to increase exposure after two years of markdowns.

Figure 3: Infrastructure and Credit Lead the 2025 Playbook

Source: Balentic Investor Survey 2025

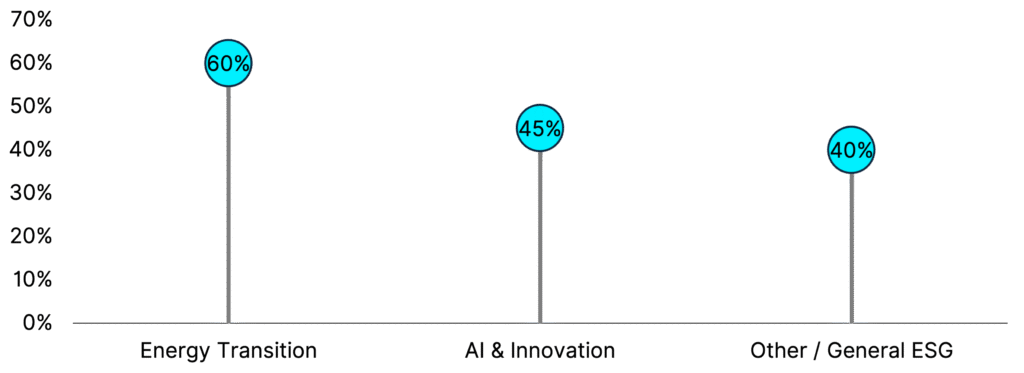

Thematically, the survey reveals clear conviction around the energy transition and AI-driven innovation. Nearly 60% of LPs ranked energy transition investments among their top three priorities. Many view the theme as extending beyond renewables into grid modernization, storage, and industrial decarbonisation. In parallel, 45% of respondents highlighted artificial intelligence as a cross-sector opportunity, particularly within venture and growth equity.

Figure 4: Energy Transition Tops the LP Agenda

Source: Balentic Investor Survey 2025

Secondaries also continue to rise in prominence. One in three LPs expect to allocate more to secondary strategies in 2025, a reflection of both liquidity needs and the maturation of the GP-led market. Continuation funds remain a source of both opportunity and scrutiny: several LPs noted concerns around pricing transparency and governance, underscoring the continued need for alignment as the market scales.

Regional nuance and global rebalancing

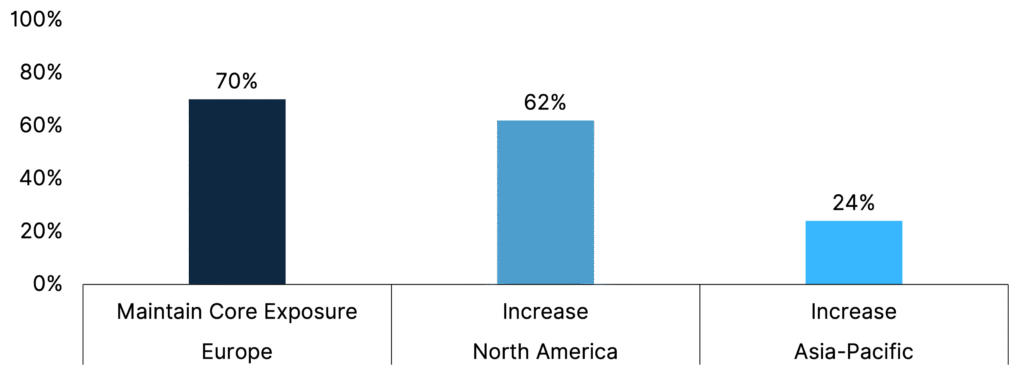

Geographically, Europe remains the anchor of most institutional portfolios, but investors are edging back toward global diversification. Roughly 62% of respondents intend to maintain or increase exposure to North America, where perceived policy stability and innovation depth continue to appeal. Meanwhile, Asia-Pacific allocations are expected to rise modestly, with 24% of LPs planning to grow exposure – a cautious re-entry after some years of regional pullback.

Figure 5: LPs Rebalance Globally - Without Leaving Europe Behind

Source: Balentic Investor Survey 2025

The UK and continental Europe tell slightly different stories. Continental investors show growing confidence in domestic mid-market private equity and energy infrastructure, while UK LPs appear more globally oriented, citing “geographic balance” as a portfolio priority for the year ahead.

Several investors across the region also pointed to secondary opportunities in European buyouts, where discounted NAVs have created an entry point that aligns with longer-term value creation.

A mood of measured conviction

The overarching mood among European LPs is one of measured conviction. After some years of digestion and re-pricing, capital is once again preparing to move, but with discipline rather than exuberance.

Energy transition and private credit are emerging as the twin engines of new deployment, while secondaries and infrastructure seemingly serve as stabilisers in uncertain conditions.

Private markets are evolving into a more pragmatic phase, less momentum-driven, more fundamentals-focused.

For institutional investors, 2025 looks less like a pause and more like a recalibration: the quiet rebuilding of exposure in sectors and strategies built to endure.

Stay Illiquid!

Kasper

More Insights

Balentic Edge

Sign up to keep up to date with the latest news and updates.

© 2025 Balentic ApS. CVR: 44034255. All rights reserved.

Privacy Policy | Terms of Service

The Balentic website and Orca are, and are expected to continue to be, under development. Consequently, some of the features described in this Overview and/or on the website may not yet be available or may work differently. Some features may furthermore not be available to all users.