Co-investing is for the 1% - Co-investments are not created equal

Private equity co-investments come with varying levels of risk. While motivations and prerequisites for co-investing are critical considerations (as discussed in previous posts), understanding the nuances of risk at the co-investment level is equally important.

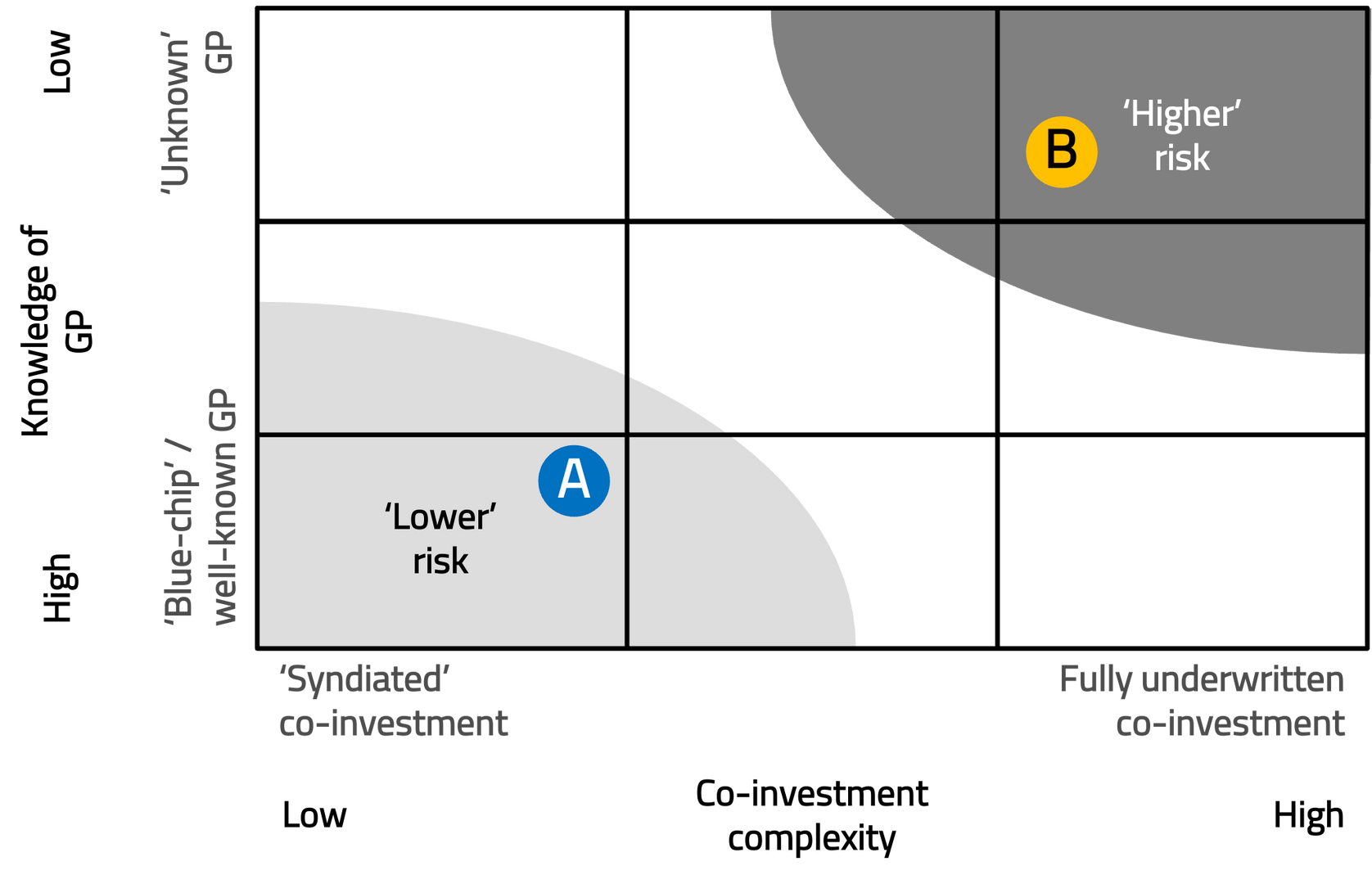

LPs who want to approach co-investing strategically can benefit from thinking methodically about risk. One practical tool is the Co-Investment Risk Matrix, which helps plot opportunities based on two factors:

- Knowledge of the GP (Y-axis)

- Co-Investment Complexity (X-axis)

The Co-Investment Risk Matrix

The matrix plots co-investments according to how well the LP knows the GP (on the Y-axis) and the complexity of the co-investment itself (on the X-axis). This provides a tangible sense of risk, both at an absolute level and relative to other co-investments.

For example, a co-investment opportunity positioned higher on the Y-axis (low GP knowledge) and further right on the X-axis (high complexity) would typically carry a higher level of risk and require a corresponding increase in expected returns to justify the investment.

Y-Axis: Knowledge of the GP

All else being equal, the more an LP knows about a GP before co-investing, the lower the risk. LPs who have tracked a GP over several fund cycles, conducted rigorous primary fund due diligence, and made prior commitments have significantly more insight into how the GP operates.

In contrast, co-investing with an unfamiliar GP increases risk, as the LP would need to perform due diligence on both the GP and the specific investment—often under tight timelines.

For syndicated co-investments with so-called “Blue-chip” GPs—large, established managers with robust co-investment processes—the risk of GP-related issues is generally lower. However, this doesn’t necessarily mean the investment is attractive. The more knowledge an LP has, the better equipped they are to make an informed decision.

X-Axis: Co-Investment Complexity

Co-investment complexity varies widely and plays a critical role in assessing risk.

- Syndicated Co-Investments: These typically carry less risk, as the GP handles much of the heavy lifting, such as setting terms and organizing data rooms. While execution risks remain, they are relatively lower, and LPs expend fewer resources.

- Fully Underwritten Co-Investments: These are significantly more complex and riskier. LPs need to move quickly to meet tight deadlines, absorb potential broken deal costs, and bring domain expertise to the table. A well-resourced and aligned team is essential to navigate these challenges successfully.

Risk Varies by LP

profiles for two LPs, depending on their knowledge of the GP and available resources.

For example:

- LP 1: Has extensive knowledge of the GP through prior commitments and plots a syndicated co-investment in the lower-left quadrant of the matrix (low risk).

- LP 2: Has limited experience with the same GP and plots the same opportunity further up the Y-axis, indicating higher relative risk.

All else being equal, LP 2 should demand higher expected returns to compensate for the additional risk.

Co-Investment Risk vs. Investment Risk

While related, co-investment risk and investment risk are distinct concepts.

- Co-Investment Risk: This refers to risks associated with the co-investment process, such as knowledge of the GP and complexity of the deal.

- Investment Risk: This focuses on the inherent risks of the underlying asset, including market conditions, sector dynamics, and execution risks.

For example, in the Co-Investment Risk Matrix:

- Co-Investment A: An early-stage venture capital opportunity in carbon capture technology, with high GP familiarity, may have low co-investment risk but high investment risk.

- Co-Investment B: A large buyout of a leading safety component manufacturer for commercial airlines, with limited GP familiarity, may have higher co-investment risk but lower investment risk.

Key Takeaways

For LPs, a systematic approach to assessing co-investment risk is crucial. Tools like the Co-Investment Risk Matrix can help LPs navigate the complexities of co-investing by providing a clear framework for evaluation.

Ultimately, successful co-investing requires a balance of knowledge, resources, and strategy. LPs must understand their risk tolerance, assess each opportunity methodically, and ensure alignment with their overall portfolio goals.

Stay tuned for the next post, where we’ll explore how to classify and evaluate specific co-investment opportunities.

Stay Illiquid – and stay strategic!

Kasper Wichmann, CEO Balentic

More Insights

Balentic Edge

Sign up to keep up to date with the latest news and updates.

© 2025 Balentic ApS. CVR: 44034255. All rights reserved.

Privacy Policy | Terms of Service

The Balentic website and Orca are, and are expected to continue to be, under development. Consequently, some of the features described in this Overview and/or on the website may not yet be available or may work differently. Some features may furthermore not be available to all users.