Defense

Target Locked: The Rising Case for Defense in Private Markets - Part 1

The landscape of defense investing has undergone a dramatic transformation, moving from the periphery of institutional portfolios to the heart of private market strategy.

Defense is increasingly recognized as a significant and expanding investment theme within private markets, encompassing private equity, venture capital, infrastructure, and private debt. This is the first installment of a three-part blog series that delves into defense investing within the private markets context.

“The supreme art of war is to subdue the enemy without fighting.”

Sun Tzu

Executive Summary

- Defense investing has evolved from ESG exclusion lists to mainstream private market opportunities following geopolitical shifts and technological convergence

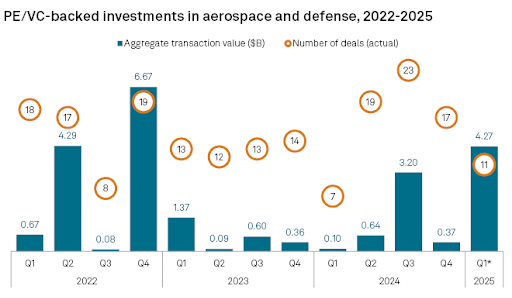

- More than USD 4bn was deployed into defense-aligned private market deals in early 2025 alone, exceeding the entire 2023 total and almost as much as 2024

- Both specialist and generalist general partners are carving distinct roles, bringing unique advantages from regulatory expertise to operational scale

- ESG frameworks are evolving to incorporate national security considerations, with many institutional investors distinguishing between different types of defense exposure

The Quiet Revolution in Defense Capital

Private capital is quietly reshaping the defense industry landscape. From Silicon Valley venture firms to European buyout specialists, a new investment thesis is crystallising around national security, technology sovereignty, and strategic resilience.

Once relegated to ESG exclusion lists alongside tobacco, gambling and other “sin” industries, defense investing has experienced a remarkable rehabilitation. Russia’s full-scale invasion of Ukraine, escalating tensions with China, and political uncertainty in Europe have fundamentally altered the investment conversation.

The numbers tell a compelling story. According to S&P Global Market Intelligence, more than four billion dollars was deployed into defense-aligned private market deals in early 2025 alone. This figure already exceeds the entire 2023 total, signalling an unprecedented acceleration in capital flows toward defense-related opportunities.

Figure 1: PE/VC-backed Investments in Aerospace and Defense, 2022-2025

Redefining Modern Defense Technology

Today’s defense sector bears little resemblance to the heavy industrial complex of previous decades. The transformation encompasses a fundamental shift from traditional hardware-centric approaches to technology-driven solutions that blur the lines between military and civilian applications.

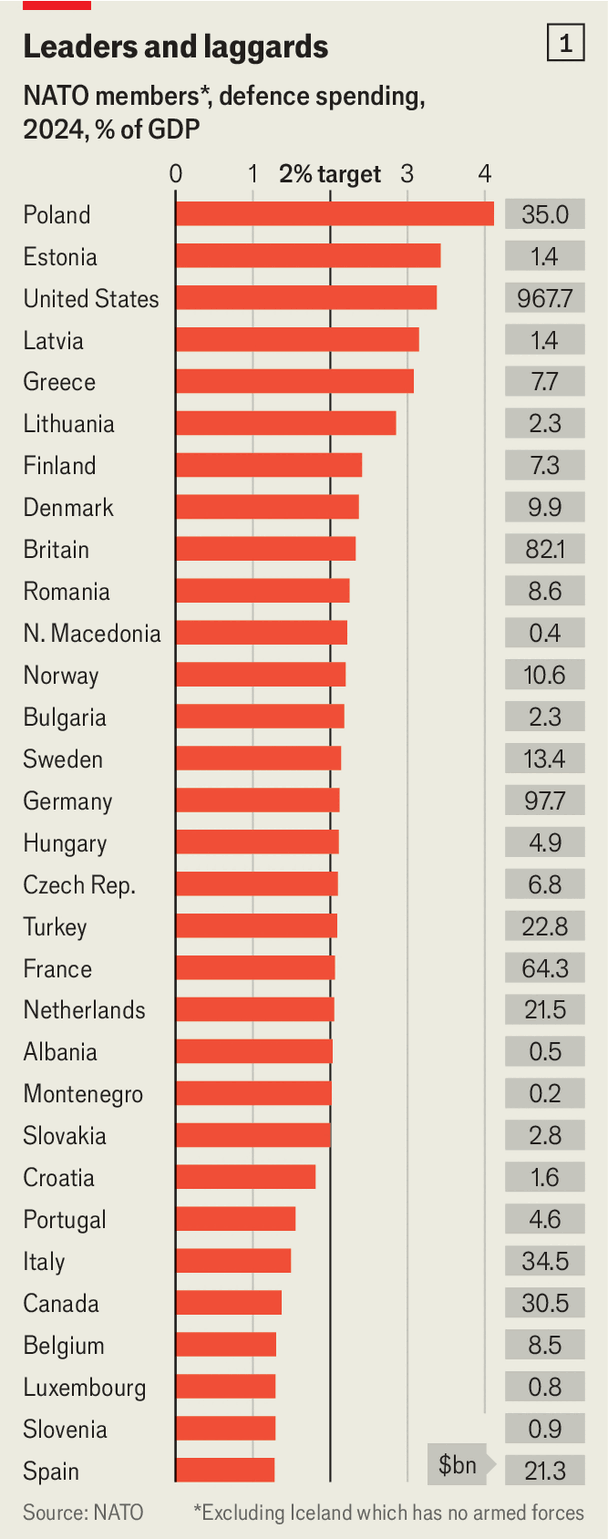

As can be seen in Figure2 below, NATO countries are dramatically increasing their defense budgets, with Germany’s reversal of decades of underinvestment serving as a particularly striking example. This spending surge extends beyond conventional weapons systems to encompass satellites, sensors, software, and sophisticated cyber defense capabilities.

Heavily influenced by what is going on in Ukraine, the modern battlefield increasingly resembles a technology laboratory. Autonomous systems, artificial intelligence applications, and space-based infrastructure are attracting capital from both specialist defense investors and generalist managers seeking exposure to cutting-edge innovation.

Supply chain dynamics are also undergoing profound change. Governments are actively calling for localisation and redundancy in critical defense capabilities, opening substantial opportunities for private capital to fund modernisation initiatives across both industrial and digital defense layers.

Figure 2: NATO Members Defense Spending, 2024 as % of GDP

The Private Markets Advantage in Defense

Private markets offer several distinct advantages for defense investing that public markets struggle to match.

- Access to Cutting-Edge Technology: Many groundbreaking advancements in areas like AI, cybersecurity, and autonomous systems are originating from private tech companies. Investing in these private entities allows defense to tap into this innovation directly.

- Agility and Speed: Private companies often operate with greater agility compared to large public corporations, enabling faster development cycles and quicker deployment of critical technologies.

- Specialized Expertise: Private equity firms and venture capitalists often bring specialized industry knowledge and operational expertise, which can help optimize defense-related businesses.

- Long-Term Investment Horizon: Private market investments typically have a longer-term horizon, aligning well with the often protracted development cycles of defense technologies.

Key Investment Themes Emerging

As can be seen in Table 1 below, private market defense investing spans a wide array of cutting-edge areas. Cybersecurity solutions protect critical infrastructure and defense systems from increasingly sophisticated cyber threats, whilst artificial intelligence applications drive intelligence, surveillance, reconnaissance, and autonomous operations.

Robotics and autonomous systems development focuses on unmanned aerial vehicles, ground vehicles, and marine systems that serve both military and commercial applications. Advanced materials research produces lightweight, durable, and stealth materials that find applications across multiple industries.

Space technologies represent a rapidly growing segment, with innovations in satellite communication, geospatial intelligence, and space-based defense attracting substantial investment. Data analytics tools and platforms for processing vast amounts of defense-related information complete the technological landscape.

Table 1: Key Investment Areas

| Investment Area | Description |

|---|---|

| Cybersecurity | Solutions to protect critical infrastructure and defense systems from cyber threats. |

| Artificial Intelligence (AI) | AI-driven applications for intelligence, surveillance, reconnaissance, and autonomous operations. |

| Robotics and Autonomous Systems | Development of unmanned aerial vehicles (UAVs), ground vehicles, and marine systems. |

| Advanced Materials | Research and production of lightweight, durable, and stealth materials. |

| Space Technologies | Innovations in satellite communication, geospatial intelligence, and space-based defense. |

| Data Analytics | Tools and platforms for processing and analyzing vast amounts of defense-related data. |

Specialist vs Generalist Approaches

The defense investment landscape features two distinct approaches, each with unique advantages and risk profiles. Specialist general partners such as Arlington Capital, AE Industrial Partners, and Veritas Capital lead the sector with deep experience and regulatory fluency.

These firms bring security clearance capabilities and extensive government relationships that prove invaluable when navigating the complex procurement landscape. Their funds are tightly aligned with defense outcomes and possess intimate knowledge of procurement realities.

Generalist managers including Carlyle, Advent International, KKR and Blackstone have made increasingly significant moves in aerospace, cybersecurity, and dual-use infrastructure. While these firms may lack domain-specific expertise, they compensate with substantial operational capabilities and acquisition scale.

Table 2: Leading Private Markets Players in Aerospace & Defense

| Investment Area | Specialist GP | Generalist GP |

|---|---|---|

| Private Equity | Arlington Capital Partners, AE Industrial Partners, Veritas Capital | Tikehau Capital, Carlyle Group, KKR, Blackstone, Advent International |

| Venture Capital | Shield Capital, DCVC, 8VC | Andreessen Horowitz, General Catalyst, Kleiner Perkins |

| Infrastructure | Anchorage Capital, Star Mountain Capital | Stonepeak Partners, Blackstone Infrastructure, Brookfield |

| Private Credit | Ares Management, PennantPark | Apollo Global, Blackstone Credit, Owl Rock Capital |

The entry of generalist GPs signals the sector’s mainstream acceptance and provides additional validation for the investment thesis. Their involvement brings larger pools of capital and sophisticated operational capabilities that can accelerate growth and improve efficiency.

LP Perspective: Opportunities and Considerations

For LPs, the defense opportunity presents both compelling attractions and unique challenges that require careful consideration. Defense investments may offer downside protection and thematic exposure during uncertain times, but reputational and regulatory risks loom large.

Stakeholder perception, treaty alignment, and ESG framing all matter significantly more in defense than in traditional private market investments. LPs must carefully consider how defense exposure aligns with their broader mission and stakeholder expectations.

The sector’s defensive characteristics appeal to LPs seeking diversification and downside protection. Government customers provide stable, often inflation-linked revenues through multi-year contracts that offer insulation from many economic risks.

Risk Management Requirements

Defense investments require enhanced due diligence processes that go well beyond traditional private equity evaluation criteria. Customer concentration risk is inherent, as government customers often represent the majority of revenues for defense contractors.

Long development cycles can delay revenue recognition and extend payback periods beyond those typical in commercial markets. Complex procurement processes introduce additional delays and potential cost overruns that must be carefully evaluated.

Technology obsolescence risks prove particularly acute in rapidly evolving threat environments. Investments in specific technologies may become obsolete quickly as adversaries develop countermeasures or new threats emerge.

Practical Recommendations for LPs

LPs considering defense exposure should begin by clarifying their institutional position on defense investments and establishing clear policy guidelines. These frameworks should address geographic restrictions, technology limitations, and end-use considerations.

Mapping existing defense exposure across current portfolios often reveals higher exposure than initially anticipated. Defense-adjacent assets may exist within infrastructure, technology, or industrial allocations without being explicitly labelled as defense investments.

GP evaluation in defense requires assessment of government relationships, security clearance capabilities, and regulatory compliance frameworks. Strong government relationships prove essential for identifying opportunities and navigating procurement processes.

Key Due Diligence Questions for LPs

When evaluating defense opportunities, LPs should ask GPs about their security clearance capabilities and government contracting experience. Understanding the specific types of products or services being funded further helps assess alignment with institutional values.

Investigating customer bases for any sanctioned or high-risk jurisdictions prevents potential compliance issues. Establishing how ESG risk is monitored across the portfolio ensures ongoing alignment with institutional objectives.

Understanding mechanisms that prevent technology misuse provides additional governance comfort. These questions help LPs make informed decisions whilst maintaining appropriate risk management standards.

—

This overview of defense investing’s transformation sets the stage for deeper exploration.

In Part 2, we’ll examine the evolving ESG frameworks that are reshaping institutional approaches to defense investments, alongside the infrastructure and credit opportunities that are attracting increasing attention from sophisticated investors.

Stay Illiquid!

Kasper

—

Sources:

More Insights

Balentic Edge

Sign up to keep up to date with the latest news and updates.

© 2025 Balentic ApS. CVR: 44034255. All rights reserved.

Privacy Policy | Terms of Service

The Balentic website and Orca are, and are expected to continue to be, under development. Consequently, some of the features described in this Overview and/or on the website may not yet be available or may work differently. Some features may furthermore not be available to all users.