Defense

Target Locked: The Rising Case for Defense in Private Markets - Part 2

ESG frameworks are undergoing significant evolution as institutional investors grapple with defense exposure in an increasingly complex geopolitical environment. The traditional approach of blanket exclusions is giving way to more nuanced frameworks that distinguish between different types of defense activities.

“In matters of style, swim with the current; in matters of principle, stand like a rock.”

Thomas Jefferson

Executive Summary

- ESG frameworks are evolving from blanket defense exclusions to nuanced approaches that distinguish between defensive capabilities and controversial weapons

- Infrastructure investments in defense-related assets offer sovereign-grade off-take agreements with attractive risk-adjusted returns for institutional investors

- Private credit strategies are filling the gap left by traditional banks, supporting scaling companies with strong government order books

- Geographic diversification opportunities are expanding as European defense capabilities accelerate following geopolitical realignments

Rewriting the ESG Framework for Defense

ESG frameworks are undergoing significant evolution as institutional investors grapple with defense exposure in an increasingly complex geopolitical environment.

Some LPs continue to exclude the entire defense category from their portfolios, viewing any military-related investment as incompatible with their ESG mandates.

Others now permit exposure to NATO-aligned technologies, defensive capabilities, or dual-use assets that support civil society alongside military applications.

The “S” in ESG presents the most complex considerations, as national defense can be viewed as supporting social stability, protecting democratic institutions, and safeguarding civilian populations. This perspective opens the door to viewing certain defense investments as aligned with social responsibility objectives.

Enhanced Due Diligence Requirements

Due diligence requirements in defense investing far exceed those of typical private equity investments. Investors must thoroughly interrogate GPs’ access to government, their compliance protocols, and the granularity of ESG disclosures.

End-use monitoring and export licence tracking should be considered non-negotiable elements of any defense investment process. These requirements add complexity but provide essential protections against reputational and regulatory risks.

The limited pool of cleared personnel drives up costs whilst creating barriers to entry that can protect market positions for established players. Understanding these dynamics proves critical for successful defense investment strategies.

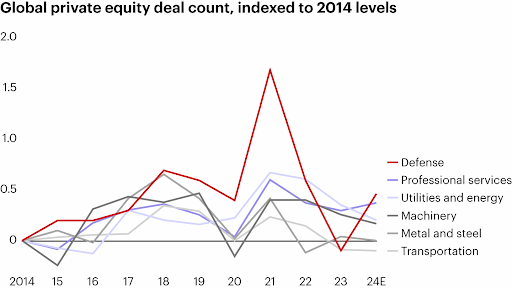

Figure 1: Private equity investment in aerospace and defense has grown in line with comparable industries

Infrastructure and Critical Assets

Infrastructure investments in defense-related assets present compelling opportunities for LPs seeking long-term, stable returns. Defense housing, training facilities, and resilient telecommunications infrastructure are already or will receive substantial long-term public-private backing.

The physical infrastructure supporting modern defense capabilities extends far beyond traditional military bases. Satellite ground stations, secure data processing facilities, and hardened communications networks all require substantial capital investment.

Stonepeak’s move into secure communications infrastructure and Blackstone’s stake in QTS Data Centers exemplify this trend toward infrastructure investments with both commercial and defense applications. These assets offer the long-term, stable cash flows that infrastructure investors seek.

Recent examples demonstrate the sector’s appeal to infrastructure investors. Hardened data centres supporting government communications networks offer twenty-year service agreements with sovereign counterparties, providing inflation-linked returns with minimal technology risk.

Private Credit Fills the Funding Gap

Private credit is also playing an increasingly important role in the defense ecosystem. Aerospace suppliers and cybersecurity contractors often require working capital during extended procurement cycles, creating opportunities for growth debt and milestone-based lending arrangements.

Traditional banks are reluctant to provide these financing structures due to regulatory complexity and reputational concerns. Private credit managers with defense expertise can command attractive spreads whilst supporting critical defense innovation.

A recent European example illustrates this trend: a drone analytics firm secured seventy-five million euros in growth debt to scale its multi-domain battlefield platform. Repayment was tied directly to government contract milestones, providing investors with government-backed cash flows.

Contract financing, invoice securitisation, and export-backed credit lines are expanding rapidly as companies seek alternative funding sources. These structures align investor returns with government procurement cycles whilst supporting technological advancement.

Geographic Diversification Opportunities

The defense investment landscape varies significantly across different geographic markets, each presenting unique opportunities and challenges.

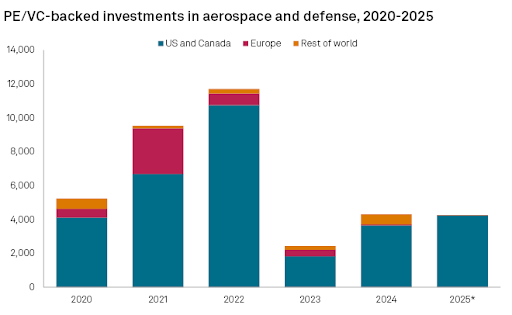

The US remains the dominant market, and anecdotally European defense ventures are accelerating rapidly as the continent reassesses its security priorities. But, as can be seen in Figure 2 below, investments in Aerospace & Defense in Europe is starting from a low base and leaves much to be desired.

Doing this necessitates substantial resources from LPs, particularly in terms of thoroughly screening a larger portion of the investment landscape to identify and eliminate underperforming managers, while also aiming to select managers with the potential to outperform in the coming decade.

Figure 2: PE/VC-backed Investments in Aerospace & Defense

Nonetheless, cross-border defense ventures in Scandinavia and investment platforms in France and Germany are gaining momentum as European governments seek to reduce dependence on non-European suppliers. Tikehau Capital’s focus on mid-market aerospace and defense assets exemplifies this trend toward European consolidation.

For a deeper dive into Tikehau’s Aerospace & Defense strategy have a look at our recent chat with Tikehau Capital’s Co-CIO Thomas Friedberger on Balentic Edge “Inside Tikehau Capital’s private equity Aerospace & Defense Strategy”.

The fragmentation of global supply chains creates opportunities for private capital to fund modernisation and resilience initiatives across multiple jurisdictions. This trend toward localisation and redundancy opens substantial opportunities for investors willing to navigate complex regulatory landscapes.

Regulatory Navigation Complexities

The regulatory environment surrounding defense investments presents both challenges and opportunities that require specialised expertise to navigate successfully. Export control regulations, foreign investment restrictions, and security clearance requirements add layers of complexity.

National security considerations can override commercial logic in ways that create unpredictable policy risks for investors. Policy risk is another factor. Procurement cycles can span administrations. Budget shifts, export bans, or geopolitical realignment can impact investment outcomes. Defense exposure must be diversified across geographies and vintages.

Thus as was pointed out in the recent Balentic Edge podcast with Simon Powell on “Thematic Investing” , it is critical that policy is an additional tailwind and is not what underpins the base case.

Compliance capabilities prove critical for avoiding penalties and maintaining operating licences. Strong regulatory frameworks are essential for successful defense investment strategies, as violations can result in severe penalties including loss of export privileges.

Innovation in Dual-Use Technologies

The VC ecosystem is experiencing a renaissance of defense innovation, with firms from Anduril to Helsing.ai representing a new wave of dual-use startups. Defense innovation is no longer confined to traditional prime contractors.

This dual-use approach creates multiple value creation pathways for investors. Technologies initially developed for defense applications increasingly find commercial applications, whilst civilian innovations prove adaptable for military use.

The convergence expands addressable markets and creates additional exit opportunities for venture investors. Artificial intelligence platforms developed for battlefield analytics find applications in commercial logistics, whilst autonomous vehicle technologies serve both military and civilian markets.

Strong Growth in VC backed Defense Investments

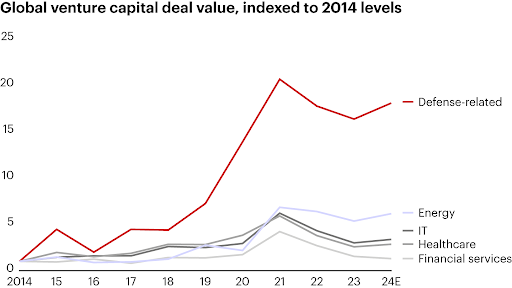

This renaissance can also be seen in the value of VC deals in the defense sector, which according to a recent report by Bain & Company, has increased 18 fold in the past 10 years, significantly outpacing deal value in other industries, see Figure 3 below.

This, according to Bain & Company, is the result of multiple factors including the US Department of Defense’s efforts to engage and fund early-stage companies and the increasing convergence of commercial and defense technologies.

Additionally the European Defense Renaissance, see below and Part 1, alongside the success of firms Palantir, SpaceX, and Anduril, which have achieved significant defense market share, will encourage further investment.

Figure 3: Venture capital investment in defense is up sharply since 2019

European Defense Renaissance

European defense capabilities are experiencing unprecedented investment following Russia’s invasion of Ukraine, see also Part 1. The European Investment Fund’s InvestEU Defense Equity Facility represents a structural commitment to defense industrial capacity building.

German defense spending increases alone represent a market opportunity exceeding one hundred billion euros over the coming decade. This spending surge creates opportunities across the entire defense value chain, from prime contractors to specialist component suppliers.

French and Nordic defense cooperation initiatives are attracting private capital seeking exposure to next-generation defense technologies. These collaborations combine technical expertise with substantial government backing, creating attractive investment opportunities.

Portfolio Construction Considerations

Portfolio construction should balance specialist and generalist exposure while, as always, considering geographic, vintage year, and sub-sector diversification. Defense spending patterns can vary significantly across political cycles and regions, requiring thoughtful diversification strategies.

Vintage year diversification proves particularly important in defense investing, as procurement cycles and geopolitical events can create temporal variations in opportunity sets. Spreading investments across multiple years helps smooth these cyclical effects.

Sub-sector diversification across cybersecurity, aerospace, maritime, and land systems reduces exposure to technology-specific obsolescence risks. This approach provides exposure to defense growth whilst managing concentration risks inherent in government contracting.

Risk Assessment Framework

Customer concentration risk also requires careful evaluation, as government customers often represent the majority of revenues for defense contractors. Understanding procurement processes and budget cycles proves essential for accurate risk assessment. Here LPs and GPs should strongly consider ‘hedging their bets’ by investing in technologies and firms developing dual-use applications and products.

Technology obsolescence risks demand continuous monitoring of threat evolution and countermeasure development. Investments must demonstrate adaptability and upgrade pathways to maintain relevance in rapidly changing threat environments.

Regulatory compliance risks can create significant financial and reputational exposure. DD must thoroughly evaluate compliance capabilities, export control procedures, and security clearance protocols across portfolio companies.

LP Implementation Strategies

LPs should develop clear allocation frameworks that specify acceptable defense exposure levels and sub-sector preferences. These frameworks should align with institutional values whilst capturing attractive investment opportunities.

Manager selection requires evaluation of both investment capabilities and regulatory expertise. Successful defense investing demands understanding of procurement processes, security clearance requirements, and export control regulations.

Ongoing monitoring should track regulatory developments, geopolitical changes, and technology evolution that could impact portfolio companies. Regular reviews ensure continued alignment with institutional objectives and risk tolerances.

—

The infrastructure and ESG evolution in defense investing demonstrates the sector’s maturation from niche specialty to mainstream institutional consideration.

Building on Part 1 and Part 2, Part 3, will explore the future outlook for defense investing, examining emerging technologies, exit strategies, and the practical steps limited partners should take to capitalise on this transformative investment theme.

Stay Illiquid!

Kasper

—

More Insights

Balentic Edge

Sign up to keep up to date with the latest news and updates.

© 2025 Balentic ApS. CVR: 44034255. All rights reserved.

Privacy Policy | Terms of Service

The Balentic website and Orca are, and are expected to continue to be, under development. Consequently, some of the features described in this Overview and/or on the website may not yet be available or may work differently. Some features may furthermore not be available to all users.