Heard on the private equity fundraising trail (Part 1)

Private equity fundraising can be an intricate dance between GPs and LPs. For GPs, interpreting LP feedback during and after a pitch can be challenging—especially when they fall into the trap of “canned pitching” (as explored in earlier posts).

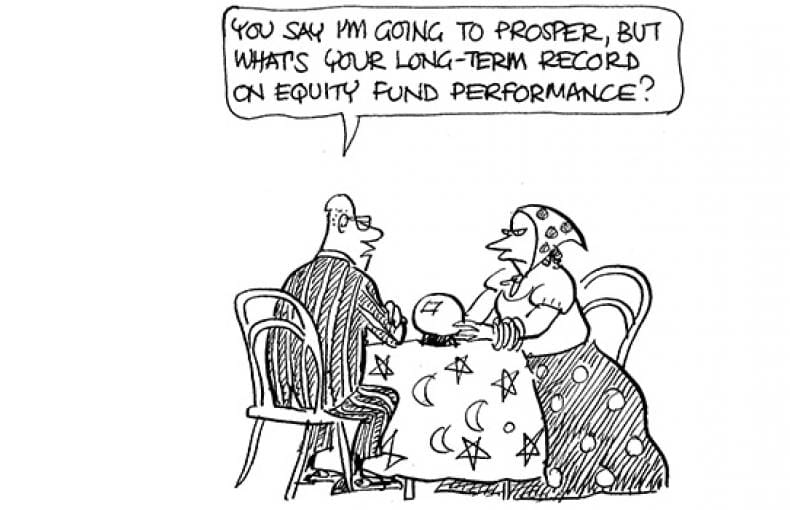

This article takes a light-hearted but insightful look at some of the standard statements, questions, and feedback from LPs. For GPs, it’s a chance to understand the subtext and turn these interactions into opportunities for learning and relationship-building.

“We don’t invest in [geography/stage/strategy].”

This is one of the most frustrating statements a GP can hear, particularly when the mismatch could have been identified before the meeting. However, it happens more often than one might expect.

The result? GPs find themselves awkwardly trying to “fit” their fund into the LP’s preferred parameters. For example, convincing an LP that ABC Ventures isn’t really a venture fund but a growth fund is rarely effective.

Instead of trying to contort your pitch, use the moment to ask for the LP’s perspective on your strategy. Surprisingly, these uninterested LPs often provide more honest and valuable feedback than those actively considering an investment. At worst, you’ve wasted a meeting, but at best, you’ve gained insights that could refine future pitches.

“We would need to have an LPAC seat.”

For some LPs, the idea of securing a spot on the Limited Partner Advisory Committee (LPAC) is a significant motivator to invest. This is especially true for institutions like Development Financial Institutions (DFIs), where the perceived stature of having an LPAC seat often outweighs the practicalities of their role.

GPs frequently encounter LPs who can’t clearly articulate what they would do with the seat—or why their relatively small commitment warrants one. For GPs, balancing the LPAC while accommodating these requests is critical. Recognizing this motivation early on can help manage expectations while maintaining the fund’s governance integrity.

“ESG/Impact/SRI is very important to us.”

In today’s market, this has become a standard phrase, particularly from European LPs. While many GPs are adjusting to this expectation, the reality can be confusing. For some LPs, especially larger ones, this emphasis on ESG or SRI (Socially Responsible Investing) is often more of a “box-ticking exercise” than a deal-breaker.

If a GP is a UN PRI signatory and includes ESG in their investment process, it’s often enough to satisfy these LPs. This creates opportunities for GPs:

- Genuine Differentiation: GPs can stand out by demonstrating robust ESG practices, showcasing measurable impact, and positioning themselves as leaders in this space.

- Efficient Box-Ticking: While more cynical, aligning with baseline ESG expectations ensures LPs can report positively to their stakeholders.

However, given the increasing importance of ESG in investment decisions, the latter is likely a shortsighted strategy.

Turning Feedback Into Opportunity

The statements and questions shared here may sound standard, but for GPs, they represent valuable opportunities to learn and adapt. Whether it’s using a mismatched pitch to gain honest feedback, accommodating LPAC requests tactfully, or leveraging ESG expectations for differentiation, these interactions can help GPs refine their approach and strengthen relationships with LPs.

Stay tuned for Part II, where we’ll explore more of these LP favorites and what they mean for GPs.

As always, keep pitching, keep listening, and stay illiquid!

Kasper Wichmann, CEO Balentic

More Insights

Balentic Edge

Sign up to keep up to date with the latest news and updates.

© 2025 Balentic ApS. CVR: 44034255. All rights reserved.

Privacy Policy | Terms of Service

The Balentic website and Orca are, and are expected to continue to be, under development. Consequently, some of the features described in this Overview and/or on the website may not yet be available or may work differently. Some features may furthermore not be available to all users.