NAV Loans Unlocked: Navigating Risk and Opportunity - Part 1

NAV loans are rapidly reshaping the private equity financing landscape, offering both promise and peril.

This post delves into how NAV loans function, their market dynamics, the crucial considerations for LPs and GPs, and what the future holds.

“Our job as fund managers is to make sure our investors’ capital is well used: to create additional value, to support the companies that need it, to support the shareholders that are doing the right thing, to help companies remain the leaders in their fields. In short, to focus on what has the right purpose.”

Pierre-Antoine de Selancy, cofounder of 17Capital

Key takeaways

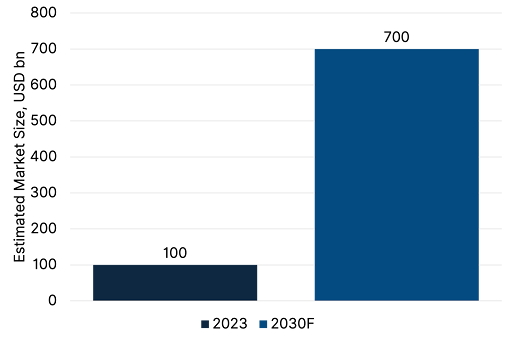

1) NAV loans are no longer niche. What began as a specialist financing tool is now a $100B+ market projected to reach $600–700B by 2030, driven by GPs’ growing need for mid-to-late life fund liquidity.

2) NAV financing is structurally distinct. Unlike subscription lines backed by LP commitments, NAV loans are collateralized by fund assets—adding complexity and changing the risk profile at the fund level.

3) The lender landscape is shifting fast. Specialist funds and private credit managers are stepping in where banks face regulatory constraints, offering bespoke solutions with greater speed and flexibility.

Demystifying NAV Loans: How Do They Work?

Net Asset Value (NAV) financing represents a specific type of fund-level lending within private markets. It is primarily offered to private equity funds, secured against the calculated NAV of their underlying investment portfolios.

These facilities provide non-dilutive capital, often structured as debt or sometimes preferred equity. They serve as a tool for fund managers, or General Partners (GPs), seeking liquidity or strategic capital later in a fund’s life.

The Core Mechanism

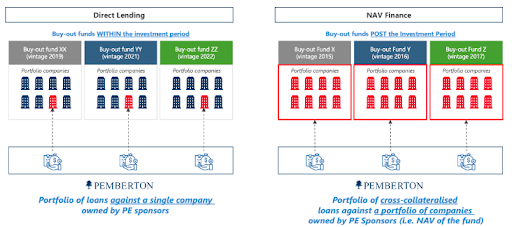

At its heart, a NAV loan is collateralised by a diversified pool of assets held within the fund. Lenders advance capital based on a prescribed loan-to-value (LTV) ratio, which typically ranges from a conservative 5% up to 30% of the portfolio’s NAV. This contrasts with the higher LTVs often seen in traditional direct lending – see Figure 1, below.

Figure 1: Direct Lending and NAV Financing

While NAV loans are usually senior-ranking instruments at the fund level, meaning the lender has priority for repayment from fund distributions before equity holders (the Limited Partners), they are structurally subordinate to any debt held directly by the underlying portfolio companies. Cash flows from portfolio companies exits or recapitalisations must first service company-level debt before flowing up to the fund level to repay the NAV lender.

Repayment primarily relies on these cash flows generated from the underlying investments. Loan agreements often include covenants such as minimum portfolio diversity requirements or maximum LTV thresholds, which, if breached, can trigger accelerated repayment mechanisms or even default.

Timing and Structure

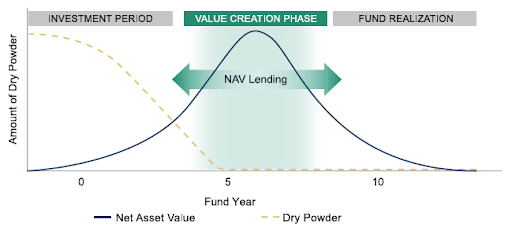

Unlike subscription credit lines, which are secured against LP commitments and used early in a fund’s investment period, NAV loans typically come into play later. As can be seen in Figure 2, they are most common during the ‘value creation’ phase or towards the end of the investment period when most LP capital has been drawn.

Figure 2: NAV Lending is Primarily Used During the Value Creation Phase

NAV financing structures can be bespoke, tailored to the borrower’s needs and the portfolio’s characteristics. While senior secured loans are common, structures can vary, including preferred equity or ‘recourse-lite’ arrangements where the lender’s claim is limited primarily to fund cash flows rather than the GP’s equity stakes in the assets.

The Rise of NAV Financing: Market Size and Key Players

The NAV financing market, while existing in various forms for years, has seen a dramatic acceleration in adoption recently, particularly within private equity.

Once a niche product, it is rapidly becoming a significant feature of the fund finance landscape. Current market size estimates place it at approximately USD 100 billion, but projections suggest substantial future expansion.

Explosive Growth and Future Potential

Industry participants and analysts forecast remarkable growth. Some sources, like Partners Group and Pemberton (citing Rede Partners), suggest the market could reach USD 600-700 billion by 2030. This implies a compound annual growth rate (CAGR) potentially nearing 30%, far outpacing many other private market segments.

This rapid ascent mirrors the earlier trajectory of subscription finance, which evolved from a novel technique to a near-ubiquitous tool used by almost 90% of private equity funds.

Figure 3: NAV Financing Market Growth Projection

What’s Fuelling the Boom?

Several factors underpin this growth. A challenging exit environment and longer portfolio holding periods have increased GPs’ need for liquidity, both to return capital to LPs and to support existing investments.

NAV loans provide capital for value-creation activities like follow-on M&A or organic growth initiatives within portfolio companies. They also offer an alternative to selling assets in the secondary market, potentially at steep discounts, allowing GPs and LPs to retain upside exposure while accessing liquidity.

Furthermore, the need to finance GP commitments to new funds or provide liquidity solutions directly to LPs has also contributed to demand.

The Changing Lender Landscape

A key evolution is the shift in providers. Historically dominated by banks, the market is increasingly served by specialist non-bank lenders, including dedicated NAV finance funds and large private credit managers.

Banks face limitations due to regulatory capital constraints (Basel III/IV), balance sheet pressures, and a preference for shorter maturities (typically 3-5 years). They may also be less flexible regarding structures like delayed-draw facilities or preferred equity, which can be capital-intensive for them.

Specialist funds, backed by institutional capital, are stepping in to fill this gap. They often offer greater flexibility, longer maturities, larger deal sizes, and speed of execution. Firms like 17Capital (now majority-owned by Oaktree), Pemberton, and Partners Group are prominent examples of players actively building capabilities in this space, alongside other credit funds and advisors.

This shift mirrors the evolution seen in direct lending, where non-bank lenders have captured significant market share from traditional banks.

Key Participants

The ecosystem involves several players: the borrowers (primarily PE fund managers), the lenders (such as Goldman Sachs, Morgan Stanley, JPMorgan Chase, Apollo Global Management, and 17Capital), advisors who help structure deals, rating agencies who may assess the creditworthiness of facilities, and ultimately the LPs whose fund interests form the basis of the collateral.

As NAV loans shift from niche to norm, their strategic use is accelerating and reshaping liquidity, fund structuring, and investor expectations across private markets.

But the real impact lies not just in how these tools work—but in how they’re used.

In Part 2, we explore the double-edged nature of NAV financing: the benefits it unlocks for GPs, the risks it introduces for LPs, and the governance frameworks needed to navigate this new frontier.

Stay Illiquid!

Kasper

Sources

- Neuberger Berman. (February 2024). A Perspective on Private Equity NAV Loans.

- Pemberton. (February 2024). NAV Financing – Evolution within Fund Financing.

- Oaktree Capital Management. (March 2024) NAV Finance 101: The Next Generation of Private Capital

- 17Capital. (March 2024). NAV Finance 101: The Next Generation of Private Credit.

- Partners Group. (January 2025). Fund finance: NAV financing unlocked

More Insights

Balentic Edge

Sign up to keep up to date with the latest news and updates.

© 2025 Balentic ApS. CVR: 44034255. All rights reserved.

Privacy Policy | Terms of Service

The Balentic website and Orca are, and are expected to continue to be, under development. Consequently, some of the features described in this Overview and/or on the website may not yet be available or may work differently. Some features may furthermore not be available to all users.