Energy Transition - a multi-trillion dollar investment opportunity for private markets

“The energy transition represents one of the most significant investment opportunities of our lifetime. Private markets are uniquely positioned to drive this change at scale.”

Larry Fink, Chairman and CEO, BlackRock, 2024

Introduction

The global shift towards sustainable energy sources is reshaping the investment landscape, creating substantial opportunities for private market investors across private equity, infrastructure, venture capital, and private debt.

Understanding where these opportunities lie, and how best to capitalise on them, is crucial for LPs and GPs seeking robust returns alongside meaningful environmental impact.

This post dives into energy transition, the opportunity, the drivers and the risks, but first some key takeaways:

- Energy transition presents a multi-trillion-dollar opportunity across private equity, infrastructure, venture capital, and private debt

- Private markets offer unique advantages due to long-term horizons, specialised expertise, and active ownership

- Significant opportunities lie within mature technologies and emerging innovations like green hydrogen and carbon capture

- Navigating regulatory complexity and technological risks requires sophisticated investor strategies

The Scale of the Opportunity is Massive

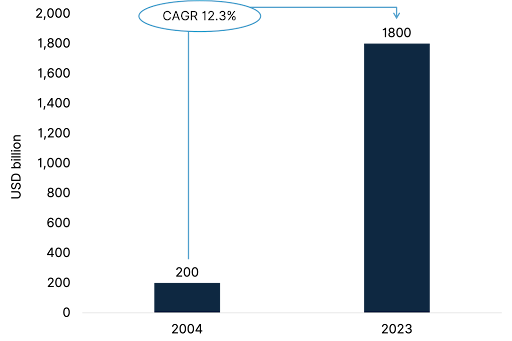

Investment in energy transition has surged dramatically, from $200bn in 2004 to surpassing $1.8 trillion in 2023, for a CAGR of 12.4% – a clear sign of accelerating market maturity and compelling risk-return profiles.

Private markets are increasingly pivotal in this transformation due to their flexibility, long-term focus, and ability to actively manage and grow sustainable ventures.

Figure 1: Growth of Global Energy Transition Investments (2004–2023)

Key Drivers of the Energy Transition

Several interrelated factors are propelling the energy transition forward, creating a fertile environment for private market investments and turning energy transition into a long-term sustainable mega-trend.

1. Climate Change Imperatives

The escalating impacts of climate change have galvanized global efforts to reduce greenhouse gas emissions. Governments and corporations are setting ambitious net-zero targets, necessitating substantial investments in clean energy technologies and infrastructure.

2. Technological Advancements

Rapid innovation has led to significant cost reductions in renewable energy technologies. For instance, the cost of solar photovoltaic modules has decreased by over 80% in the past decade, making renewables more competitive with fossil fuels.

3. Policy and Regulatory Support

Governments worldwide are implementing policies to accelerate the energy transition. The European Union’s Green Deal and the U.S. Inflation Reduction Act provide substantial incentives for clean energy investments, while China’s commitment to peak carbon emissions by 2030 underscores global policy momentum.

4. Investor Demand for Sustainable Assets

Driven by underlying investor demand alongside regulatory requirements, institutional investors are increasingly seeking ESG-compliant assets. According to Schroders, impact investing assets under management reached $1.6 trillion globally, with energy transition investments constituting the largest share at 21%.

5. Energy Security Concerns

Geopolitical tensions, not least in Europe, and supply chain disruptions have highlighted the vulnerabilities of fossil fuel dependence. Diversifying energy sources through renewables enhances national energy security and reduces exposure to volatile fossil fuel markets.

Opportunities Across Private Market Sub-Asset Classes

Alongside compelling risk-adjusted returns this is helping drive opportunities across private markets.

Venture Capital: Fueling Innovation

Venture capital remains at the forefront, backing disruptive startups in battery technology, EV charging, grid management systems, and green hydrogen. The potential for outsized returns is substantial but matched by higher technology and commercialisation risks.

Funds like Breakthrough Energy Ventures exemplify success through strategic, early-stage backing of high-potential technologies.

Growth and Buyout: Scaling Solutions

Growth equity and buyout strategies focus on scaling proven technologies and platforms.

Firms such as Brookfield and EQT are acquiring renewable energy companies and positioning them as leaders in rapidly evolving markets, delivering predictable cash flows alongside growth potential.

Infrastructure: Essential Foundations

Infrastructure investment is indispensable, particularly in renewable energy generation, grid modernisation, and storage. Transmission and grid upgrades alone require trillions of dollars in capital, offering stable, long-term returns.

Leading managers include Macquarie and Global Infrastructure Partners, whose portfolios exemplify strategic investment in essential energy infrastructure.

Private Debt: Enabling Growth

Private debt increasingly underpins the energy transition, providing essential financing for projects and companies unable to access traditional lending.

Goldman Sachs Asset Management highlights opportunities in commercial solar, sustainable aquaculture, and emissions reduction technologies, demonstrating how debt solutions diversify portfolios and support crucial development.

Leading managers include Macquarie and Global Infrastructure Partners, whose portfolios exemplify strategic investment in essential energy infrastructure.

Real Estate: Green Buildings and Efficiency

Real estate investments in energy-efficient buildings and sustainable urban infrastructure offer stable returns coupled with environmental benefits.

Managers like Blackstone and KKR focus on retrofitting buildings, reducing energy use, and enhancing property value through sustainability improvements.

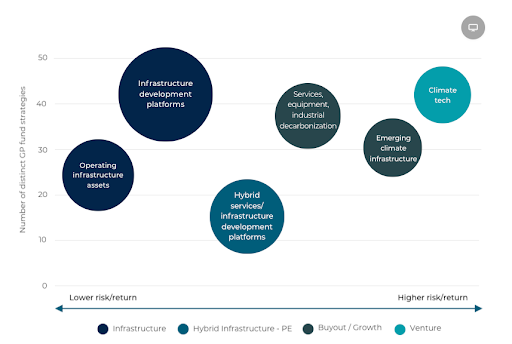

Figure 2 below shows how these sub-asset classes along number of fund strategies and risk/return. As investors consider how to approach energy transition investing they can use this as a backdrop to think about their portfolio construction.

Figure 2: Climate and energy transition specialist GP landscape

Why Private Markets?

Long-term Investment Horizons

Private markets provide unique advantages for energy transition investments due to their inherently long-term investment horizons. They can afford patience and flexibility, allowing for sustained focus on strategic, complex, and innovative projects with longer payback periods, essential for infrastructure and emerging technologies.

Active ownership

GPs often play a hands-on role, leveraging deep sector knowledge and expertise to guide companies through complex operational, technological, and regulatory landscapes. This proactive management approach can significantly enhance value creation and ensure alignment with sustainability goals.

Domain Expertise

Private markets enable GP and LPs to capitalise on specialised expertise and industry-specific insights. This expertise is particularly crucial in navigating the complexities associated with energy transition technologies, regulations, and market dynamics.

As such, specialised GPs are well-positioned to identify, evaluate, and manage investment risks effectively, maximising returns while advancing sustainability outcomes.

Diversification to Reduce Portfolio Risk

Diversification potential also distinguishes private markets, providing investors with varied exposure across different geographies, technologies, and asset types. Such diversification helps balance portfolio risks, offering resilience against individual market disruptions or technology failures.

Risks in Energy Transition Investing

While the opportunities are significant, GPs and LPs must also consider several risks:

Technological Risk

Investing in energy transition projects, while promising substantial rewards, carries inherent risks that investors must navigate carefully.

Technological risks stand prominently, as many innovative solutions are at early stages of development or commercialisation. Uncertainty around scalability, performance, and market adoption requires rigorous technical due diligence and ongoing risk management strategies.

Regulatory and Policy Risks

This may significantly influence investment viability and returns. Energy transition projects often rely on government incentives, subsidies, and supportive regulatory frameworks.

Changes in political priorities, policy revisions, or shifts in subsidies can profoundly impact project economics. GPs and LPs must stay vigilant, proactively assessing and managing these regulatory uncertainties.

Execution Risks

Execution risks also pose challenges, particularly for large-scale infrastructure and renewable energy projects. Factors such as supply chain disruptions, cost overruns, project delays, and unforeseen technical issues can derail projects.

GPs must carefully vet operational expertise, supply chain management capabilities, and contingency planning strategies of project teams and management.

Market Risk

Market risk remains another crucial consideration, driven by volatility in energy prices, shifts in demand, and competition from established fossil fuel industries.

Both GPs and LPs need to consider and evaluate market dynamics thoroughly, ensuring their portfolio companies have robust competitive strategies and diversified revenue streams to withstand market fluctuations.

Effectively navigating policy risk is essential

LPs should adopt a geographically diversified approach, mitigating the impact of local or regional policy shifts. Engaging GPs with deep regulatory expertise and robust government relationships can further protect against policy-related vulnerabilities.

Moreover, GPs should rigorously evaluate the underlying economic viability of projects independently of government incentives. Assessing projects based on fundamental economics ensures resilience to policy fluctuations and enhances long-term investment stability.

Proactively understanding potential policy changes, staying informed of political developments, and aligning investments with long-term regulatory trends can further safeguard against unexpected policy disruptions.

GPs must carefully vet operational expertise, supply chain management capabilities, and contingency planning strategies of project teams and management.

Exits and Realising Value

Successful exits in energy transition investments typically occur via strategic sales, initial public offerings (IPOs), or secondary sales to other private market investors.

Strategic sales to industrial or energy sector companies remain particularly attractive, providing these businesses immediate entry into emerging sustainable markets. High-profile examples include Ørsted’s acquisitions of renewable assets to rapidly expand its global presence.

IPOs have become increasingly common as renewable energy companies achieve sufficient scale and market traction. Recent successful IPOs, such as Tesla’s solar and battery operations and renewable energy developer Neoen, underscore strong public market appetite for proven energy transition companies.

Secondary sales also offer viable exit routes, enabling asset recycling and reinvestment into newer ventures. Infrastructure funds frequently buy assets from early-stage investors, attracted by the stable cash flows these mature assets provide.

Secondary market liquidity continues to grow, boosted by dedicated renewable infrastructure investors such as Brookfield Renewable and Global Infrastructure Partners, who actively pursue established renewable portfolios.

Robust exit strategies are essential for realising value and maintaining LP confidence, and GPs must demonstrate clear pathways and flexibility in response to market dynamics and investor appetite.

Practical Recommendations for LPs

To effectively capitalise on energy transition opportunities, LPs should:

- Prioritise GPs demonstrating proven track records, robust technical expertise, and deep sector-specific knowledge

- Emphasise diversified strategies across geographies and sub-asset classes to balance risk

Conduct rigorous due diligence on technological and regulatory assumptions underpinning investment theses - Question managers about their exit strategies, policy risk mitigation, and operational capabilities to manage execution risks

Conclusion: Charting Your Course

Energy transition investing offers unprecedented opportunities to generate strong returns and contribute to a sustainable future. Success hinges on sophisticated strategies, rigorous risk management, and selecting managers adept at navigating complexities

By understanding and strategically responding to these dynamics, private market participants can significantly impact the global transition while achieving attractive financial outcomes.

Stay Illiquid!

Kasper

More Insights

Balentic Edge

Sign up to keep up to date with the latest news and updates.

© 2025 Balentic ApS. CVR: 44034255. All rights reserved.

Privacy Policy | Terms of Service

The Balentic website and Orca are, and are expected to continue to be, under development. Consequently, some of the features described in this Overview and/or on the website may not yet be available or may work differently. Some features may furthermore not be available to all users.