Navigating Private Markets in Times of Uncertainty

Launch Orca Request a call Back to Balentic Edge Navigating Private Markets in Times of Uncertainty Insights from SuperReturn International Berlin “Private markets aren’t immune to uncertainty; they’re shaped by how effectively we respond to it.” Serena Williams, Venture Investor, Serena Ventures From 2–6 June 2025, I attended the SuperReturn conference in Berlin at the InterContinental […]

NAV Loans Unlocked: Navigating Risk and Opportunity – Part 2

NAV loans unlock GP flexibility—but introduce risk for LPs. Explore the double-edged dynamics of fund-level leverage, misalignment risks, and the governance LPs need to protect returns in a fast-growing market.

NAV Loans Unlocked: Navigating Risk and Opportunity – Part 1

NAV loans are transforming private equity fund finance, with the market projected to hit $700B by 2030. Learn how this tool works, why GPs are using it, and what LPs need to watch as leverage layers build.

The Attraction and Trouble With Continuation Vehicles for LPs – Part 2

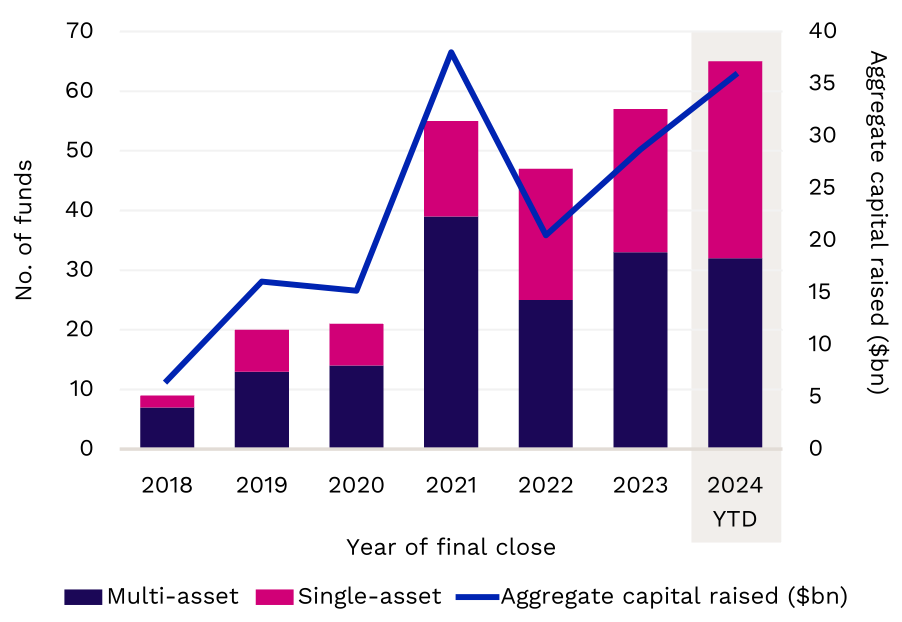

Launch Orca Request a call Back to Balentic Edge The Attraction and Trouble With Continuation Vehicles for LPs – Part 2 As discussed in the last post, Continuation Vehicles (CVs) are booming and offer good risk-adjusted return outperforming buyouts across all quartiles. But there is more to it than that. So this post takes a […]

The Attraction and Trouble With Continuation Vehicles for LPs – Part 1

Launch Orca Request a call Back to Insights The Attraction and Trouble With Continuation Vehicles for LPs – Part 1 Continuation vehicles (CVs) are booming. In a liquidity-constrained environment, they offer something close to magic: distributions to LPs while allowing GPs to hang on to prized, or what they call “trophy”, assets. On paper, it’s […]

Thematic Investing: Navigating the Future of Private Markets

Launch Orca Request a call Back to Balentic Edge Thematic Investing: Navigating the Future of Private Markets In today’s rapidly evolving investment landscape, thematic investing is no longer just an alternative strategy—it’s becoming a necessity for investors looking to capitalize on long-term structural shifts. From artificial intelligence to decarbonization, thematic investments align portfolios with transformative […]

Should you manage your private equity programme in-house or outsource it?

Launch Orca Request a call Back to Balentic Edge Should you manage your private equity programme in-house or outsource it? When an investor begins their private equity programme, it’s often not the result of careful planning or strategic execution. Instead, it can be shaped by sentiment, peer activity, or the funds currently available in the […]

Private Markets Survey 2025: Understanding LP investment strategies

Launch Orca Request a call Back to Balentic Edge Private Markets Survey 2025: Understanding LP investment strategies The private markets landscape is evolving, with institutional investors facing shifting macroeconomic conditions, changing fundraising dynamics, and new allocation priorities. The private markets landscape is evolving, with institutional investors facing shifting macroeconomic conditions, changing fundraising dynamics, and new […]

Heard on the private equity fundraising trail (Part 2)

Launch Orca Request a call Back to Balentic Edge Heard on the private equity fundraising trail. Part II Continuing from Part I, this article dives deeper into the curious, standardized questions, statements, and feedback often heard from LPs during private equity fundraising meetings. While some are well-intentioned, others can leave GPs scratching their heads—or cringing. […]

Things GPs say, probably believe, and what it means to LPs

Launch Orca Request a call Back to Balentic Edge Things GPs say, probably believe, and what it means to LPs How to present your strategy on Orca At Orca, we often hear from clients looking for direction on how to present their companies and strategies effectively on the platform. While Orca’s design is intuitive, the […]