The Attraction and Trouble With Continuation Vehicles for LPs - Part 1

Continuation vehicles (CVs) are booming. In a liquidity-constrained environment, they offer something close to magic: distributions to LPs while allowing GPs to hang on to prized, or what they call “trophy”, assets.

On paper, it’s a win-win. In practice, it’s much messier.

For LPs, CVs come with a range of challenges, not just technical and procedural, but philosophical. The original GP/LP bargain was clear: you buy something, improve it, and then sell it. LPs fund that journey and pay for the GP’s expertise in executing it.

But CVs flip that model on its head. Suddenly, the GP is no longer exiting the investment, but selling it to themselves. And LPs, often with limited time, visibility, and expertise, are expected to either roll over or exit. I.e. they are now making an investment / divestment decision.

—

This is the first part of two posts on CVs. This one looks at the growth of CVs and what makes them attractive to LPs. The next post focuses in greater detail on the challenges associated with CVs for LP.

—

Before diving into it, here is a quick summary

- CVs are booming: with app. USD 37bn raised in 2024 and a 35% CAGR since 2018 – fueled by GPs extending their holds on “trophy” assets

- Single-asset continuation vehicles (SACVs) now rival multi-asset deals, but SACV “trophy asset” labels deserve scrutiny

- Returns look strong: CVs have outperformed traditional buyouts with less than half the downside (9% vs. 19% loss ratio)

- But LPs beware: not all that glitters is gold – evaluate GP alignment, asset quality, and market appetite before rolling over

—

Exponential Growth of Continuation Vehicles

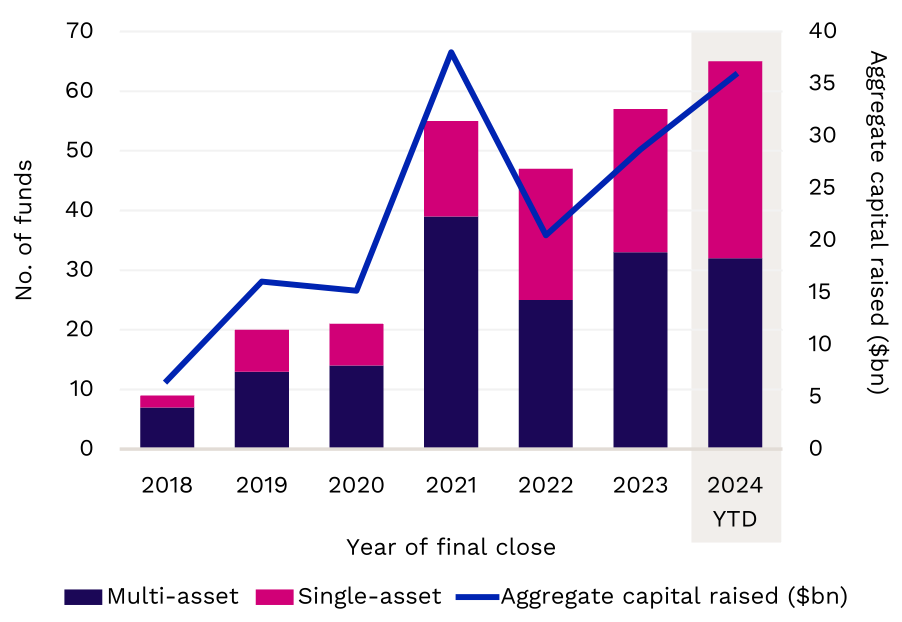

As can be seen in Figure 1 below, CVs have surged in popularity, providing GPs with mechanisms to extend their hold on prized assets while offering LPs liquidity options.

Aggregate capital raised is now around USD 37bn corresponding to a CAGR of almost 35% since 2018. Also notable is the growth in Single Asset Continuation Vehicles (SACV) which is now roughly equal with Multi Asset Continuation Vehicles (MACV).

Figure 1: Continuation Vehicles Surge

Source: Preqin, 2024

SACV, where a GP puts a so-called “trophy” Assets into a new vehicle, have thus been a significant driver of the growth of CVs in recent years. But this is the first warning flag for LPs, for what exactly is a “trophy” asset?

Evaluating “Trophy” Assets

GPs often label assets moved into CVs as “trophy” assets. However, there is no standardized definition, so LPs should critically assess and at the very least ask themselves the following

- Asset Quality: Is the asset genuinely a top performer, or is it merely the best among mediocre holdings?

- Market Interest: If the asset is truly exceptional, why aren’t external buyers competing to acquire it at a premium?

CVs offer strong returns with less downside

Even with the risk of adverse selection, a growing body of research, from academics to consultants to market participants, is pointing to a compelling truth for the growth of CVs

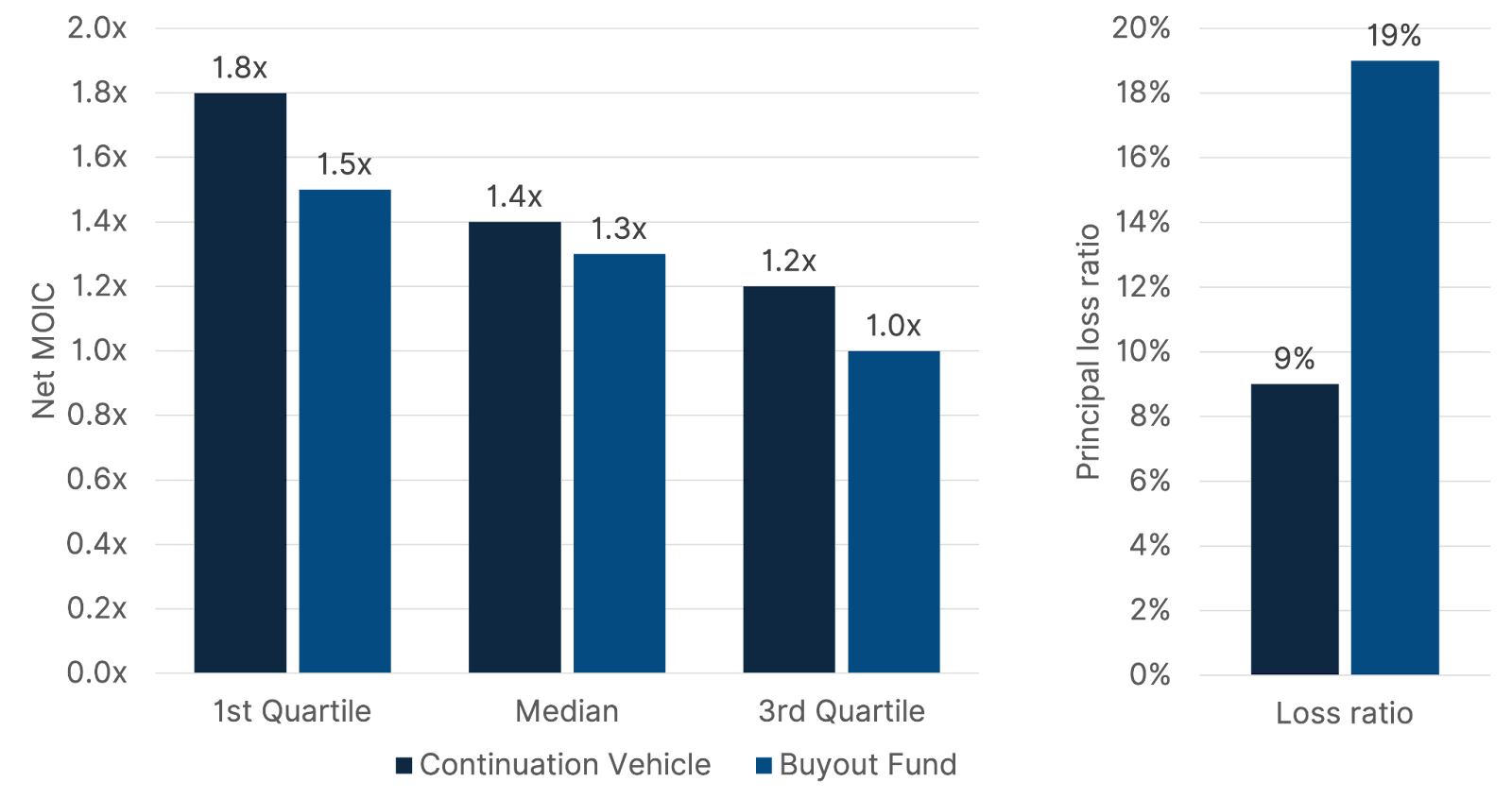

As can be seen in Figure 2, CVs may offer private equity-style returns with significantly less downside.

Figure 2: Continuation fund performance vs. buyouts (vintages 2018 – 2023)

Source: HarbourVest, 2025

Unlike traditional buyouts, CVs typically involve assets the GP already knows well – often top performers, a.k.a. “Trophy” assets that they want to keep.

That familiarity reduces risk. There’s no blind pool, no handover, and often no need for a turnaround. It’s about extending the hold on what’s already working and maximizing returns.

And, as can be seen in Figure 2, the data backs it up. Over the past five years, continuation funds have outperformed buyouts across every quartile, and with less than half the risk – 9% loss ratio versus 19% for buyouts.

That kind of risk-adjusted return profile is exactly why more LPs are paying attention and why CVs are compelling to them..

However, this rapid growth underscores the need for LPs to critically assess the implications of participating in such vehicles.

—

The next post digs deeper into that.

Until then — and ironically, in a post about liquidity…

Stay illiquid!

Kasper

Sources: Preqin 2024, HarbourVest 2025

More Insights

Balentic Edge

Sign up to keep up to date with the latest news and updates.

© 2025 Balentic ApS. CVR: 44034255. All rights reserved.

Privacy Policy | Terms of Service

The Balentic website and Orca are, and are expected to continue to be, under development. Consequently, some of the features described in this Overview and/or on the website may not yet be available or may work differently. Some features may furthermore not be available to all users.